- Soma Mater's Newsletter

- Posts

- SOMA MATER Newsletter

SOMA MATER Newsletter

June 13th 2024

Welcome to the SOMA MATER weekly newsletter. This is a weekly top 3 stories of the last week in food systems and sustainability, with the SOMA MATER analysis and perspective.

This week’s stories look at new regulation in Abu Dhabi that tries to tackle a growing arbitrage of energy subsidies for agriculture. We look at the volatility of trade with India and what that means for the UAE. Finally, a summary of the USDA Grain and Feed Report that dropped recently. We put together a summary document to download and share in case you didn't want to read all seven pages.

We are going to bring you the top three every week and would love to know what you think! Reply to the newsletter and give us your perspective!

Sustainably yours,

The SOMA team

1) Digging for Trouble: ADAFSA announces Dh10,000 fine for crypto mining on farms

The Abu Dhabi Agriculture and Food Safety Authority (ADAFSA) has issued an advisory against cryptocurrency mining on farms, describing it as a misuse of the premises. Crypto mining is a practice which involves confirming transactions and producing new coins in the blockchain, which requires significant energy, and leads to sharp increases in electricity bills. ADAFSA stated that violators of this directive will be subject to fines of up to Dh10,000.

SOMA Perspective:

The mining of crypto currency is typically an energy intensive process, requiring computers and graphic card microchips to calculate complex mathematical problems to “mine” a bitcoin. With ever increasing difficulty of mining bitcoin, mining companies scale up their equipment (meaning more computers) and require more electricity. Over the last few years more farmland owners in the UAE, who receive subsidized electricity to grow vegetables, have been offered rent to set up and run mining operations on their farms. This in turn has increased electricity demands and subverted the subsidies into covert crypto mining operations. We are concerned that this has drawn important resources from smallholder farming as the gains from this mining outweigh the returns of selling their harvest. What we are more concerned about is that the 10,000 AED fine is not high enough to deter this activity, as mining can result in hundreds of thousands of dirhams in return, making the chance fine an easy payoff. We recommend the fine be raised to protect the farmers from the lure of crypto, but also, that more policy and support be given to small holders to generate profitable business.

Source: https://www.khaleejtimes.com/uae/uae-authority-warns-of-dh10000-fine-for-crypto-mining-on-farms

2) Trading with India: A Lesson in Unpredictability

India’s foreign trade policies have an impactful and all-embracing effect in the UAE. Due to the historical trade relations that date back to ancient civilizations, both nations’ economies are deeply intertwined. As of 2024, India is the UAE's second largest trading partner and the UAE was India's third largest trading partner in 2022-2023.

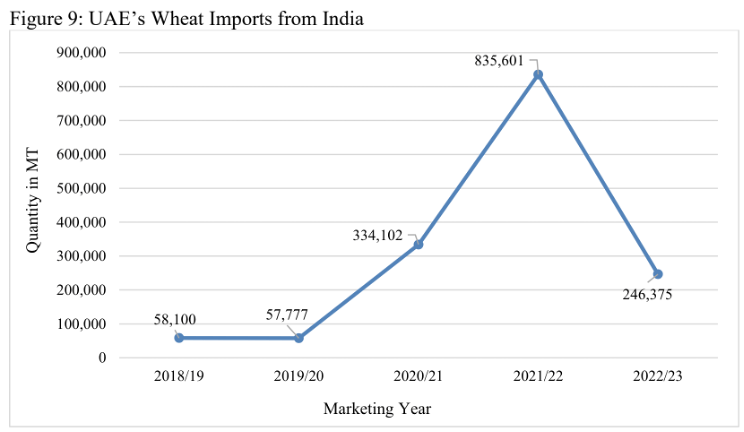

However, India’s unforeseen policy changes and export quality issues significantly weaken its reliability as a trade partner. A notable trend has been the recurring bans that India imposes on its exports. The most recent example being the ban on wheat exports announced in May 2022. This ban alone resulted in a sharp 70% drop in UAE's wheat imports from India in the 2022/23 marketing year. Older bans include the ban on non-basmati rice exports of 2007 and the ban on basmati rice exports of 2008. India also imposed an embargo on its wheat exports in 2008. These bans result in global prices increasing significantly, which impacts primarily the poorer consumers and threatens their food security.

As a result, the UAE has had to diversify its supply chains. After the 2022 export ban, the UAE sought to source arrangements with other countries like Australia, Canada, and through ‘Black Sea routes’ from Ukraine. The EU, for example, has become the largest all wheat supplier to the UAE in 2022/23 following the 2022 export ban.

Furthermore, quality concerns surrounding India's wheat have adversely affected operations in the UAE. A high percentage of foreign matter, representing 10% from a 90,000 MT shipment purchased in 2022, was reported in Indian wheat coming into the UAE. According to a USDA Grain and Feed Annual report for the UAE, this could lead to equipment damage and the need for multiple milling processes before the wheat is suitable for sale or further processing.

The impact of India’s export bans span beyond just UAE’s imports, but also exert influence on its exports. For example, as a result of the 2022 export ban, there was a 98% increase in the UAE’s all wheat exports to Sri Lanka. This placed Sri Lanka as the UAE’s biggest wheat importing country in the marketing year of 2022/23, representing nearly 20% of UAE’s total exports that year.

SOMA Perspective:

In twenty years, India’s trade policies have affected local export and import practices in the UAE. In the last two years, India’s export ban contributed to shifting the UAE’s main wheat supply to Europe and boosting the UAE’s wheat exports in South Asia. The long trade history between both nations has led to Indian trade policies having worrying levels of influence on the UAE’s food security. Thus, taking into consideration the expected population growth for both countries (with India’s expected to continue until 2064) and the increasing repercussions of climate change (which also affects food production in India), we believe in having a buffer mechanism to avoid major disruptions. Companies like Al Dahra’s Etihad Mills boast a 500,000 MT annual flour milling capacity in the UAE. However, we believe developing proactive trade is vital. This could include securing trade relationships with other major wheat and rice exports in the region to reduce the impact of these bans on the UAE.

https://www.mofa.gov.ae/en/mediahub/news/2024/2/15/15-2-2024-india2#:~:text=As a result%2C the UAE,85 billion in 2022-23.

3) Shifting Sands: Change in Trade for the UAE

On April 9th 2024, the USDA published its Grain and Feed Annual Report for the UAE, which forecasts changes in the UAE’s trade, more specifically in relation to imports.

According to the report, the primary drivers of shifts in UAE’s trade will be the increasing demand for wheat, rice, corn, and barley products, largely led by the country's growing population, an influx of foreign visitors, and the expanding livestock sectors. Another important driver to this shift is the series of international events having a direct impact on UAE imports.

The report states that ongoing tensions in the Red Sea have led shipping companies to divert their routes, increasing delivery costs and delivery time by up to 10 days. This has impacted imports from Europe, Canada, and North and South America, which traditionally use the Suez Canal route. If these tensions continue, the forecast is that UAE traders could shift to buying more from Australia, India, Russia, and Ukraine, which were not heavily impacted.

As a result of this, some changes in trade in the UAE can already be perceived, such as the decreased trade with the United States. Specifically for wheat supplies, this decline has been attributed to issues relating to distance and logistics. Indeed, in the marketing years of 2022 to 2023, American exports of all wheat to the UAE fell by 32%. Instead, other players such as the EU, Ukraine, Russia, Argentina and Australia remain major suppliers of wheat, corn, and barley to the country. In comparison to the US, many of these markets have the advantage of offering more competitive prices due to proximity, which lowers logistical costs.

Environmental factors have also added to this shift. A severe drought in Panama has slowed trade through the Panama Canal, which accounts for about 5% of global maritime trade. There has already been a 32% decline in navigation through the Panama Canal. If this continues, it could further impact the UAE's import logistics.

SOMA Perspective:

Looking ahead, the introduction of future tariffs could further intensify these changes. For instance, the European Commission proposed tariffs on grain imports from Russia and Belarus earlier in March of this year. If these tariffs are implemented, it could lead to falling Russian wheat and corn prices, and suppliers may shift to offer competitive prices to other buyers like the UAE. We believe that the UAE’s trade internationally could look different in the coming years, specifically by shifting towards the East and moving away from the Western trade routes. The need for logistical advantages in prices and trade routes will likely result in the UAE turning to more regional players for the import of major commodities in the country, in order to guarantee food security. We believe this is one of the initial reflections of the UAE joining BRICS on January 1st of this year. Due to politics or environmental factors, the UAE has already started to revise and amend its trading routes.

Summary of USDA’s Grain and Feed Annual Report for the UAE

In the 2024/25 marketing year, the UAE's demand for wheat, rice, corn, and barley is predicted to rise due to strong tourism, population growth, and expanding poultry and dairy sectors. The rise in wheat and rice consumption is driven by the growing population, increased foreign visitors, and dietary habits of the large Indian and Pakistani communities. Meanwhile, the growth in corn and barley consumption is due to increased demand from the livestock sector. However, import threats loom due to Red Sea tensions and a severe drought in Panama affecting shipping routes, and potential tariffs on grain imports from Russia and Belarus. Meanwhile, local facilities like Al Dahra, IFFCO, and a couple others have significant flour milling and storage capacities. UAE wheat imports from India dropped sharply due to a ban in 2022, and quality issues have also affected operations locally. UAE has diversified its wheat supplies with imports from EU, Türkiye, Russia, Ukraine, and Argentina, though U.S. exports have dropped due to distance and logistical issues. Argentina and Australia remain major suppliers of corn and barley, respectively, despite some environmental challenges.