- Soma Mater's Newsletter

- Posts

- Soma Mater Weekly Newsletter

Soma Mater Weekly Newsletter

Welcome to the SOMA MATER Weekly Newsletter.

At SOMA MATER, we specialize in delivering comprehensive research and advisory services with a focus on Food & Water Security and Net Zero Transition in the MENA Region. In order to support our subscribing clients in navigating these topics and understanding the regional narrative, we produce monthly Food and Water Security and Net Zero Transition Intelligence Reports, along with our in-depth analysis and insights.

This weekly newsletter highlights the top 3 stories from the past week in Food and Water Security and Net Zero transition, along with SOMA MATER's analysis and perspective.

What does the increasing demand for corn and barley in the UAE mean for agricultural sustainability and food security?

How are Oman’s recent initiatives contributing to enhancing its food security and self-sufficiency?

What are the findings of the International Energy Agency (IEA)'s 2024 Renewables market report regarding global renewable energy capacity and hydrogen production?

Sustainably yours,

The SOMA team

Grain and Water Strains: The Growing Appetite for Corn and Barley

#FoodAndWaterSecurity

A 2024 USDA report predicts increases in UAE's corn and barley consumption for Marketing Years 2024/25. Corn consumption is projected to rise 3.5% to 445,000 MT, and barley 4.3% to 365,000 MT, driven by growing livestock sector demand, especially poultry. The UAE relies heavily on grain imports, mainly for poultry feed. Ongoing Red Sea tensions pose risks to the UAE's grain imports and supply chain for MY 2023/24 and 2024/25, potentially disrupting feed ingredient flow.

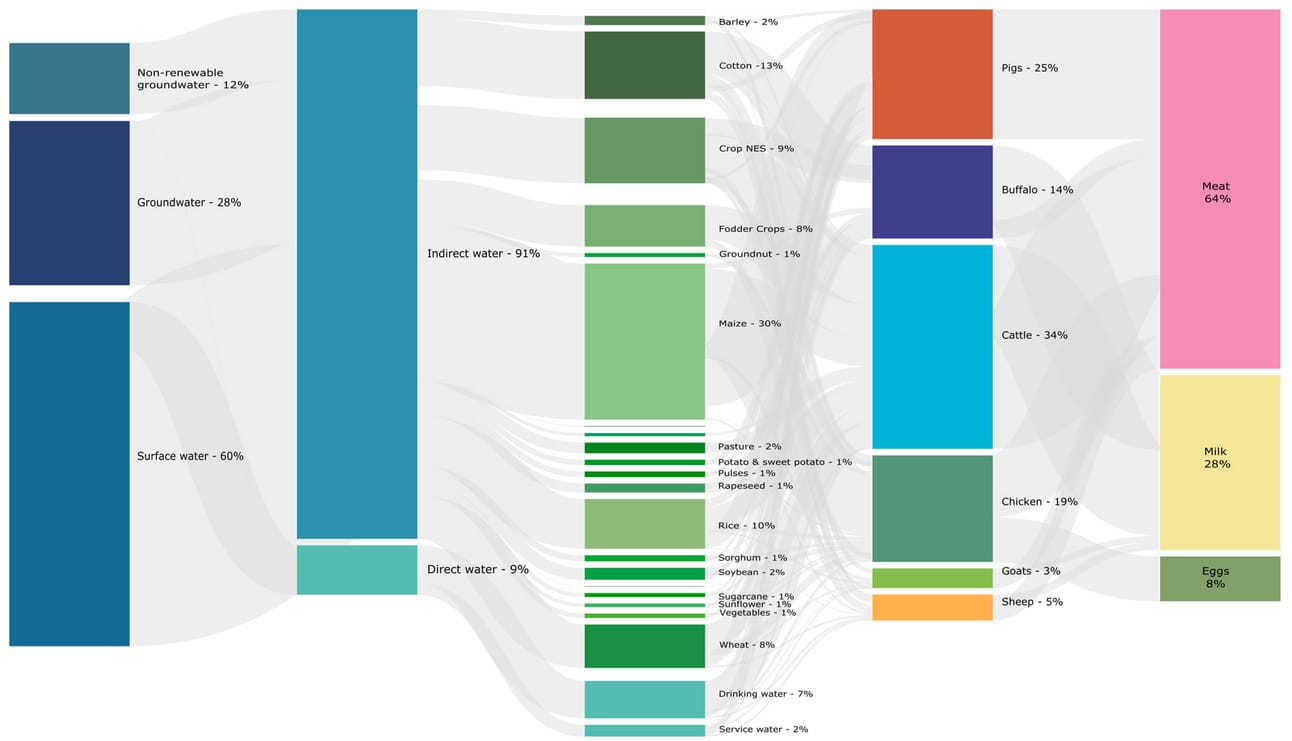

In the MENA region, about half of wheat and barley consumption is covered by local production, while corn and soybeans are mostly imported. This significantly impacts the region’s water footprint, with over 94% of the water in the region being used to produce feed for animals. This threatens regional agricultural sustainability, as livestock production accounts for over 90% of water withdrawals, going primarily for feed (Figure 1).

SOMA’s Perspective:

UAE chicken meat production is expected to grow by 17% in 2025. According to USDA reports, this is being driven by government support through feed subsidies, tech investments, and new facilities. One example is the Mleiha Poultry Farm, expected to be operational by 2025 and aiming to produce 45,000 tonnes of chicken meat annually. The expansion of the poultry industry in the region, particularly in the UAE, will impact feed consumption and import volumes. For example, India's role as a major supplier to the global grains market has diminished due to strong domestic demand and government policies. A necessary shift in supply chains as a result could lead to increased transportation costs, further impacting feed prices.

Sources:

https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Grain and Feed Annual_Dubai_United Arab Emirates_TC2024-0004.pdf

https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Poultry and Products Annual_Dubai_United Arab Emirates_TC2024-0007.pdf

Oman's Food Security Lab 2024: Cultivating Self-Sufficiency and Innovation

#FoodAndWaterSecurity

The "Food Security Lab 2024" has taken place in Oman, aiming to boost food security and create local investment opportunities. It is organized by Oman's Ministry of Agriculture, Fisheries, and Water Resources and focuses on boosting self-sufficiency and attracting investment in Oman's food sector. The lab will culminate in the signing of 30 projects, with investments totaling over OMR 10 million ($25 million). These projects aim to support crops with low self-sufficiency rates, reduce imports, increase exports, and create job opportunities for Omanis.

Oman has been making progress in key areas, with self-sufficiency rates for fish at 158%, dates at 97%, milk at 92%, and tomatoes at 83%. The success story of Oman’s wheat production, has had a fivefold increase from 2,000 tonnes in 2022 to over 10,000 tonnes this year. As Oman works towards its Vision 2040 goals, the ministry's investment project with over 130 existing projects across various governorates, has reached advanced stages.

Oman has already initiated several food and water security projects. For example, the Seawater Greenhouse project replicates the hydrologic cycle to produce freshwater from saline sources. Another example is the Grow Dome project in Sohar, developed in 2019 through a partnership between the University of Sheffield and Sohar University. It combined soilless farming techniques with solar-powered desalination to convert seawater into freshwater for agriculture.

SOMA’s Perspective:

The success stories, such as the increase in wheat production and high self-sufficiency rates in fish and dates, demonstrate the potential for further growth and innovation in Oman's food sector. Oman has the potential to play a key role as an exporter of non-oil products (including food products) across the GCC. Its year-round fishing capabilities has already made it the only net exporter of fish in the region. Oman currently accounts for over 31% of the region's fisheries production.

Sources:

International Energy Agency (IEA)'s 2024 Report: Triumphs and Challenges in Global Energy Transition

#NetZero

The IEA's 2024 Renewables market report provides projections for renewable technologies in electricity, transport, and heat sectors for 2030. It forecasts significant growth in renewable energy capacity, projecting a 2.7-fold increase by 2030 with 5,500 GW of new capacity. While this surpasses current national ambitions by 25%, it falls short of the global goal to triple renewable energy capacity set at COP28.

Outlook on the hydrogen industry has been less optimistic recently. Hydrogen's role in driving renewable capacity growth is minimal, with hydrogen produced from renewable sources expected to account for only 4% of total production by 2030. Hydrogen is projected to drive just 43 GW (less than 1%) of new renewable capacity by 2030. These challenges are due mainly to low demand. Policies are mainly spurring demand for renewable hydrogen and e-fuels in the transport sector, which is set to represent nearly 40% of renewable hydrogen demand by 2030.

MENA countries and sub-Saharan Africa are struggling to meet their announced ambitions due to implementation challenges. However, Kingdom of Saudi Arabia is leading the region's renewable capacity expansion, accounting for over 40% between 2024 and 2030. The UAE, Israel, Oman, Egypt, Iraq, and Morocco collectively represent another 44%. The UAE, Oman, and Morocco are the countries in the region expected to surpass their 2030 hydrogen ambitions.

SOMA’s Perspective:

The hydrogen industry in the region is in its nascent stages, making it challenging to navigate. However, the investments and dedication to hydrogen projects demonstrates a long-term vision for this clean energy source. While current demand may be lagging, we expect to see continued investment into Egypt and the GCC, specifically into hydrogen, as the oil-producing countries pick this as their next chapter in Energy Security.

Sources:

https://iea.blob.core.windows.net/assets/45704c88-a7b0-4001-b319-c5fc45298e07/Renewables2024.pdf or https://www.iea.org/reports/renewables-2024

SOMA MATER is writing Intelligence Reports on the topics of Food and Water Security and Net Zero Transition. If you’d like to know more, contact us through the link below: