- Soma Mater's Newsletter

- Posts

- SOMA MATER Weekly Newsletter

SOMA MATER Weekly Newsletter

Welcome to the SOMA MATER weekly newsletter.

This weekly newsletter highlights the top 3 stories from the past week in food systems and sustainability, along with SOMA MATER's analysis and perspective.

How is Egypt's prioritization of natural gas exports over local demand impacting its energy crisis?

What will be the impacts of Saudi Arabia's new oil and gas deposits on the Kingdom's long-term energy goals?

What does the UAE achieving the top global ranking in 5 environmental performance indicators signify for the country's commitment to environmental sustainability?

Sustainably yours,

The SOMA team

“Lights out”: Egypt’s Dark Energy Crisis

Electricity consumption in Egypt has seen rapid growth. Per capita consumption rose from 977 kWh in 2000 to 1600 kWh in 2019, an average annual increase of 3.4%. This trend is expected to continue due to population growth and climate change, which will increase demand for cooling and electricity.

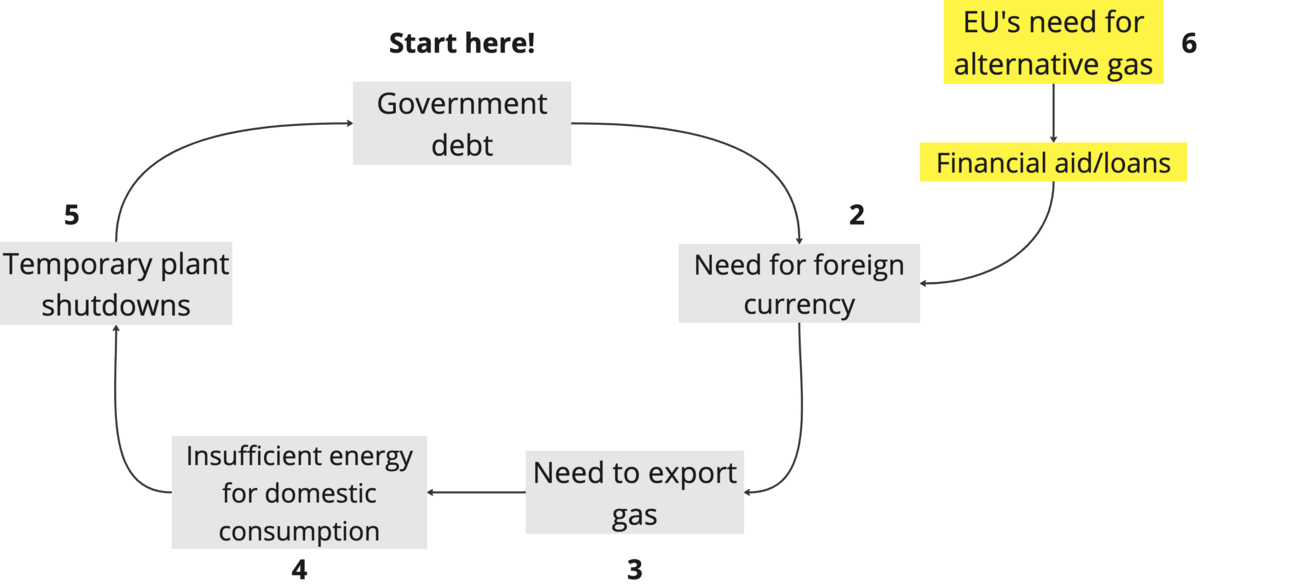

Egypt is grappling with an energy crisis. Recently, the Egyptian Electricity Holding Company extended daily blackouts to up to three hours, aiming to save natural gas for export. This move highlights a larger issue: Egypt's total external debt stands at nearly $164 billion, with $32.79 billion in debt service due in 2024. To address this, the government has prioritized natural gas exports to attract foreign currency.

This has resulted in insufficient energy for local demand, causing temporary shutdowns of fertilizer and chemical plants. This has become a cycle that highlights the need for foreign currency to flow into Egypt (Figure 1).

Global players are investing heavily in Egypt. The EU recently signed a €1 billion financing deal to support economic reforms in exchange for energy sales and controlling migrant flows to Europe. This includes €30 million for reducing pollution, decarbonization, and improving energy and resource efficiency.

Soma’s Perspective:

As an important agricultural and energy supplier, Egypt's government debt and political discontentment could hinder its ability to sustain exports. Increased foreign currency investments are flowing into the country to mitigate these issues. If Egypt continues to prioritize energy exports over local demand, it risks long-term economic instability. If political discontentment persists, we will not see a new Tahrir Square, but will see Egypt groping around, lost in the dark.

Sources:

https://www.enerdata.net/estore/energy-market/egypt/#:~:text=Electricity consumption increased by 1,by around 3%25%2Fyear.

https://www.sis.gov.eg/Story/191202/Finance-Minister-Moody’s-Downward-Revision-for-Egypt-Ignores-Gov’t-Efforts?lang=en-us#:~:text=However%2C total external debt inched,in debt service in 2024.

Saudi Arabia Strikes Liquid Gold: The Kingdom's Latest Oil Jackpot!

Early this month, Saudi Arabia’s energy minister announced the discovery of 7 new oil and gas deposits in the Kingdom’s Eastern Province and Empty Quarter. The discovery was made by state group Saudi Aramco.

The two unconventional oil fields and one reservoir in the Eastern Province produce three grades of oil (very light Arabian, ultra-light Arabian). The deposits combined produce approximately 28.89 million standard cubic feet of gas a day.

Prince Abdulaziz bin Salman said these discoveries will boost the kingdom’s economic stability and support long-term energy goals. Exploring new energy reserves aligns with Saudi Arabia’s Vision 2030 to reduce oil dependency and diversify the economy.

Gas is primarily used for power generation, space heating, and raising heat under boilers in Saudi Arabia. The electricity and heat sector is the largest contributor to the country's GHG emissions. The power sector alone accounts for nearly 40% of total emissions. In 2021, Saudi Arabia generated 238,876 GWh of electricity from gas, resulting in 182.357 Mt of CO2 emissions, which have been increasing over the past 20 years.

Soma’s Perspective:

Saudi Arabia must address the environmental impacts of these new gas reserves to meet the Saudi Green Initiative target of reducing carbon emissions and sourcing 50% of its energy from renewables by 2030. Current climate change policies are ranked "critically insufficient" by the Climate Action Tracker. The use of new gas reserves will increase Saudi’s GHG emissions. However, replacing oil use in-country could result in a step-down of GHG emissions for local infrastructure. With the speed of Saudi’s growth, and the costs of transition to gas infrastructure, current policy does not give us confidence that this switch will take place, further exacerbating the Saudi transition to Net Zero.

Sources:

https://www.energyconnects.com/news/oil/2024/july/saudi-arabia-announces-discovery-of-seven-oil-and-gas-deposits/#:~:text=Saudi Energy Minister Prince Abdulaziz,gas reservoirs"%2C SPA confirmed.

UAE Wins the Green Olympics: 1st Place in 5 Eco Events!

The UAE has ranked 1st globally in 5 environmental performance indicators and 1st in the region, the Arab world, and the GCC in the 2024 Environmental Performance Index.

The Environmental Performance Index is issued by Yale and Columbia Universities. It is a globally competitive index that assesses the current state of environmental sustainability of countries around the world.

The UAE ranked 1st in the Marine Protection Stringency, Bottom Trawling in EEZ, Wastewater treated, Wastewater reused, and Net carbon fluxes due to land cover change indicators.

In the GCC, the UAE led the ranking in 53rd place followed by Oman (54th place), Qatar (79th place), Kuwait (92nd place), KSA (106th place), and Bahrain (151th place).

Just two years prior, the UAE had also ranked 1st out of 16 countries from the “Greater Middle East”.

Soma’s Perspective:

This ranking demonstrates the extent that the UAE prioritizes and invests in its natural ecosystems. As a young country with a small infrastructure footprint on its land mass, many natural ecosystems have not suffered runaway development. The UAE leadership all grew up in these natural environments, and so have personal attachment to its conservation. The UAE is continuing to demonstrate a leader position in environment-related initiatives.

Sources:

SOMA MATER is writing Intelligence Reports on the topics of Food Security and Sustainability Transition. If you’d like to know more, contact us through the link below: