- Soma Mater's Newsletter

- Posts

- SOMA Newsletter

SOMA Newsletter

Welcome to the SOMA MATER weekly newsletter.

At SOMA MATER, we specialize in delivering comprehensive research and advisory services with a focus on Food & Water Security and Net Zero Transition in the MENA Region. In order to support our subscribing clients in navigating these topics and understanding the regional narrative, we produce monthly Food and Water Security and Net Zero Transition Intelligence Reports, along with our in-depth analysis and insights.

This weekly newsletter highlights the top 3 stories from the past week in Food and Water Security and Net Zero transition, along with SOMA MATER's analysis and perspective.

How has Egypt's wheat import market changed recently, and what role are private companies now playing in the country's wheat trade?

What recent developments have taken place in Saudi Arabia's geothermal energy sector and how does it compare to other Gulf countries' initiatives?

How has electricity demand growth in the Middle East evolved in 2024, and what are the key factors driving this increase across different countries in the region?

Sustainably yours,

The SOMA team

Rolling in the Dough: Egyptian Private Companies’ Take on Wheat Trade

#FoodandWaterSecurity

Egypt's wheat story is undergoing transformation. Private companies are now taking the lead in the market following recent changes to the state buying agency. According to projections from the United States Department of Agriculture (USDA), Egypt is set to purchase 12.5 million MT of wheat in the 2024-25 marketing year. This shift has reflected in January's import figures, where private importers accounted for 90% of the total 650,812 MT of wheat imports.

The private sector has been able to offer wheat at $10-$15/mt below current import prices. This competitive edge, combined with their established relationships with international sellers, makes it possible for Mostakbal Misr to source wheat through local Egyptian companies rather than direct international procurement. Yet, this transition raises concerns about potential supply gaps and price fluctuations if state imports fail to meet overall demand.

Egypt also plays a vital role in regional food security, providing at least 1 million MT of flour annually to neighboring countries like Palestine and Sudan. The Egyptian government is aiming at an 11% increase in local wheat purchases from farmers to reach 4 million tons in the upcoming season. This comes after the country recorded a decade-high import volume of 14.2 million tons in 2024, marking a 31% increase from the previous year.

SOMA’s Perspective:

Egypt's ongoing wheat story reflects a major transition in food security management, with the country consuming 20 million tons annually while producing less than half domestically. The recent shift from GASC to Mostakbal Misr as the main strategic commodities importer has led to private sector dominance, offering more competitive prices. The country's extensive subsidized bread program serves 70 million people, and Egypt also acts as a regional flour supplier. While new initiatives aim to reduce import dependence and save billions, there is ongoing challenges from resource constraints and implementation difficulties.

Sources:

Ground Breaking Heat: Saudi Arabia's Geothermal Game

#NetZeroTransition

EDF Saudi Arabia and TAQA Geothermal Energy Company signed an MoU to collaborate on geothermal energy technologies in Saudi Arabia, encompassing power generation, HVAC applications, and Compressed Air Energy Storage. Saudi Arabia is recognized as one of the most geothermally active countries in the Middle East, with significant potential demonstrated by the Harrat fields along the Red Sea coast, which contain abundant heat sources and hot springs.

Geothermal energy offers unique advantages as a renewable resource. Utilizing geothermal energy can help reduce CO2 emissions and local air pollutants while providing protection against energy price volatility. Technology still faces limitations in terms of transportation over long distances and the availability of suitable geothermal sources.

Saudi Arabia’s geothermal exploration dates back to 1980, but domestic applications are limited. The country's geothermal resources are primarily influenced by volcanic fields, including the LVF in western Saudi Arabia, which features basaltic lava flows, scoria cones, and volcanic domes. Currently, there remains a notable gap in comprehensive studies addressing geothermal energy potential and applications in Saudi Arabia.

Other regional players like the UAE had similar research conducted. In 2009, Reykjavík Geothermal (RG) led the search for geothermal energy for Masdar City. In 2010, the company had drilled the first low-enthalpy geothermal project in the Middle East at Masdar City. In 2023, ADNOC and the National Central Cooling Company PJSC (Tabreed) started operations at G2COOL, the Gulf Region's first district cooling project powered by geothermal energy, which then supplied 10% of Masdar City's cooling requirements. Oman also shows potential for low-enthalpy geothermal energy development.

SOMA’s Perspective:

This marks yet another step in the GCC's diversification away from fossil fuels, following the implementation of similar projects in the UAE. The Gulf countries are showing increasing sophistication in their energy transition strategies, moving beyond singular solutions to embrace a diverse portfolio of renewable technologies. This multi-faceted approach to energy transition, incorporating nuclear, solar, and now geothermal, suggests a comprehensive understanding of what it takes to achieve meaningful progress toward net-zero goals.

Sources:

Watts Up in the Middle East? High-Voltage Growth

#NetZeroTransition

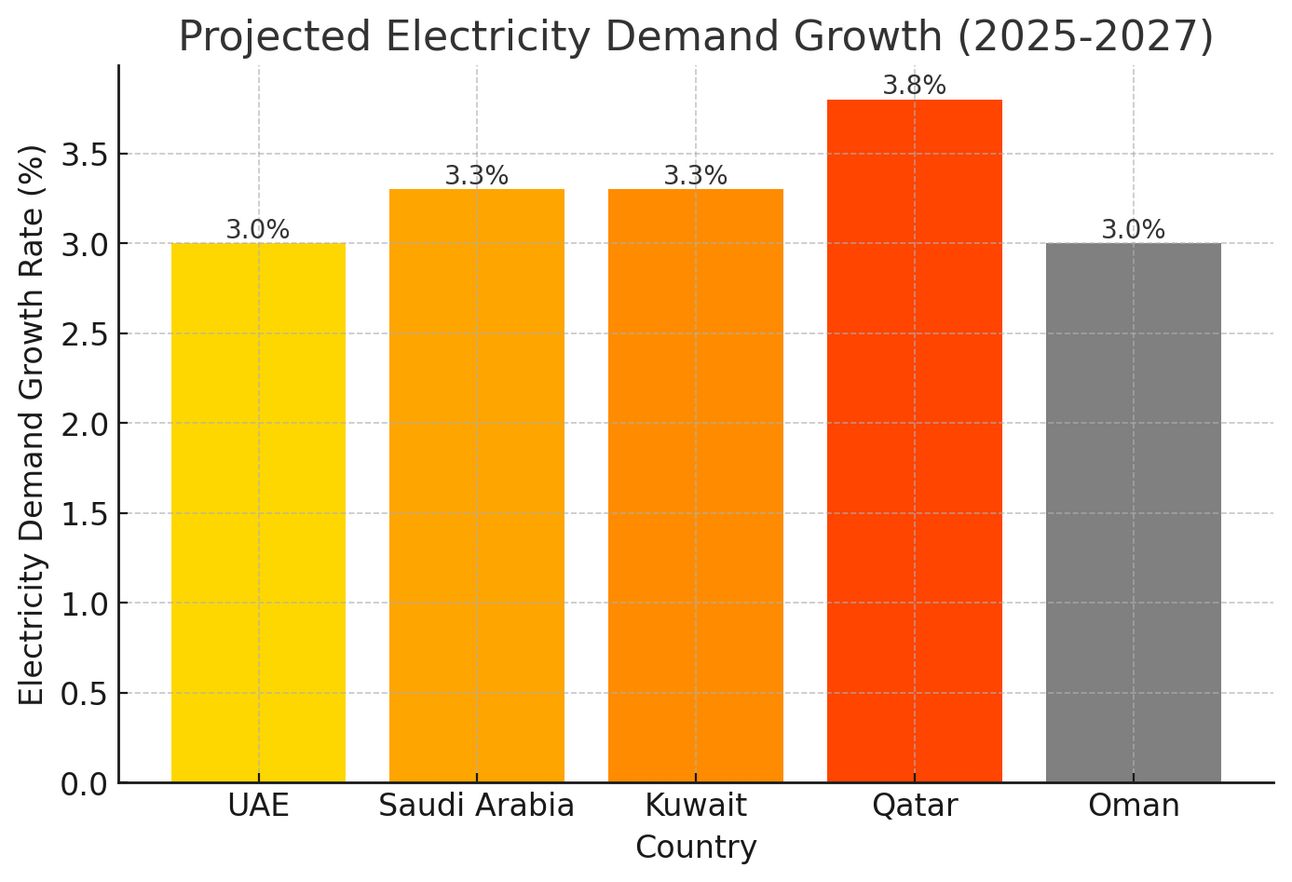

The International Energy Agency (IEA)’s Electricity 2025 report highlights electricity demand growth in the Middle East reaching 3.2% in 2024, up from 2.8% in 2023, primarily driven by increased cooling needs during the summer. The International Energy Agency (IEA) projects this trend to maintain approximately 3% growth through 2027, supported by economic expansion and sustained cooling requirements.

Saudi Arabia experienced a robust 3.5% increase in electricity demand in 2024, while strategically shifting away from oil-fired generation (-3.8%) towards natural gas and renewables, with solar PV generation exceeding 5 TWh for the first time. The UAE demonstrated significant progress in clean energy transition, with impressive growth in both solar PV (29%) and nuclear (25%) generation, leading to a 10% reduction in power sector emission intensity. Kuwait, meanwhile, faces challenges with its aging infrastructure, though plans are underway to develop 7.5 GW of new combined-cycle gas turbine capacity.

Qatar's electricity demand grew by nearly 5% in 2024, driven by economic activity and industrial expansion, particularly the Ras Laffan petrochemical complex. Oman saw a 6% increase in consumption in 2023 and is projected to significantly boost its renewable energy share from 4% to 12% by 2027. Egypt, while expanding its renewable power production by 5%, faces challenges with declining domestic gas production, particularly from the Zohr field, leading to a shift to LNG imports in 2024. According to Figure 1, Qatar leads the IEA's projected electricity demand growth among five regional countries for 2025–2027.

SOMA’s Perspective:

The Middle East's surging electricity demand presents a challenge for the its energy transition goals. This challenge becomes acute in light of the increasing energy demands from AI data centers, which will require significant cooling infrastructure. As GCC countries like the UAE and Saudi Arabia position themselves as global AI hubs, they must carefully consider this growing energy demand to successfully achieve their Net Zero targets.

Sources:

SOMA MATER is writing Intelligence Reports on the topics of Food and Water Security and Net Zero Transition. If you’d like to know more, contact us through the link below: