- Soma Mater's Newsletter

- Posts

- SOMA Newsletter

SOMA Newsletter

Welcome to the SOMA MATER weekly newsletter.

At SOMA MATER, we specialize in delivering comprehensive research and advisory services with a focus on Food & Water Security and Net Zero Transition in the MENA Region. In order to support our subscribing clients in navigating these topics and understanding the regional narrative, we produce monthly Food and Water Security and Net Zero Transition Intelligence Reports, along with our in-depth analysis and insights.

This weekly newsletter highlights the top 3 stories from the past week in Food and Water Security and Net Zero transition, along with SOMA MATER's analysis and perspective.

How has government support in Jordan been essential for Electric Vehicle (EV) growth in the country?

What are the key differences between farmed and wild salmon, and how is the Kingdom of Saudi Arabia working to develop its domestic salmon production capabilities?

What major change has occurred in Egypt's wheat procurement system, and what are the expected impacts?

Sustainably yours,

The SOMA team

Electrifying Success: Jordan's Electric Revolution Has the Middle East All Charged Up!

#NetZeroTransition

Jordan is one of the leaders in electric vehicle (EV) sales and adoption in the Middle East, with remarkable progress in recent months. About 11,000 EVs have been processed for clearance in Jordan, with an additional 1,000 vehicles expected to be cleared. The government's decision to reduce special taxes on fully electric vehicles has significantly boosted adoption.

The impact of these incentives is starting to show, with EV clearances during the first half of 2024 showing a 63% increase compared to 2023. Since May 2024, the country has welcomed 100,000 new electric vehicles, bringing the total fleet to approximately 120,000 EVs, representing 5-7% of all vehicles in Jordan. This success has positioned Jordan as one of the Middle East's leading country in battery electric vehicle sales and market share.

Complementing its EV initiatives, Jordan has also established itself as a focal point for renewable energy development, leveraging its strategic location in the global sunbelt with around 316 days of sunshine annually. The country’s Electric Power Wheeling Scheme, allows consumers to generate renewable energy at one location and use it at another through the power grid, while getting credit on their energy bills. This approach has been successful, leading to renewable energy contributing 1130 megawatts (10.8%) to Jordan's total electrical energy mix by the end of 2018.

SOMA’s Perspective:

Jordan's high fuel prices (considered a disadvantage) are catalyzing EV adoption. Each country's path to net-zero transition will be tailored to its specific circumstances and natural advantages. While some nations (like Saudi Arabia) might leverage their oil wealth to fund renewable projects, others like Jordan are turning economic pressures into drivers for sustainable innovation.

Sources:

https://www.roedl.com/insights/renewable-energy/2023/november/jordan-energy-market-for-investors-epc

Scales of Change: From Sand Dunes to Salmon

#FoodandWaterSecurity

The Excellence Center for Salmon Production was recently inaugurated in Hail, Saudi Arabia, becoming the Middle East's largest facility of its kind. A collaboration between the Ministry of Environment, Water, and Agriculture and King Abdulaziz University, the center will use advanced recirculating aquaculture systems (RAS) and aquaponics technology to produce 100,000 tons of salmon annually, aiming to reduce the country’s current salmon imports of 23,000 tons per year.

Aquaculture is the controlled breeding and harvesting of aquatic species, and is the fastest-growing food production system. While traditional marine catches have been declining in recent years (from 86.4 to 78.8 million tonnes between 1996 and 2022), aquaculture is an alternative for economic growth, food security, and reducing pressure on fish populations. For example, Abu Dhabi has seen a decrease in its commercial fish stocks, prompting the implementation of strict policies and regulations on fishing gear targeting overexploited species. These measures have led to a decrease in fisheries production, with a 77% reduction compared to 2007 levels and a 9% drop from 2021. As aquaculture production continues expanding, it has helped offset the decrease in traditional fishing output.

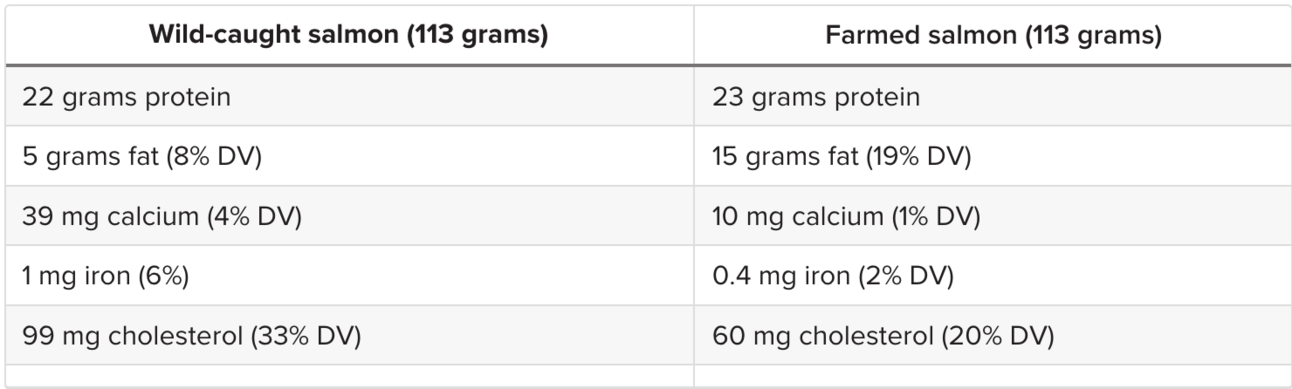

Both farmed and wild salmon offer health benefits, but there are differences in their nutritional content. Farmed salmon are fed processed fish feed, containing more fat (particularly omega-6 fatty acids) and calories than their wild counterparts (see Figure 1). They may also have higher levels of one type of persistent organic pollutant (POP) and antibiotics, though industry practices are improving. Despite these differences, both types maintain a healthy omega-3 to omega-6 ratio, making them nutritious choices.

SOMA’s Perspective:

Saudi Arabia's investment in salmon production exemplifies a recent trend SOMA has been tracking throughout 2024: the strategic pivot towards aquaculture as a key pillar of food security in the GCC. This also reflects the evolving consumer preferences and dietary patterns of the region. By leveraging advanced technology to overcome natural limitations, Saudi Arabia can reduce import dependencies while creating new economic opportunities. What is interesting to note is the high level of focus on Salmon as a fish species for consumers in the GCC states.

Sources:

Bread for Breakfast: Egypt's Double-Sized Appetite for Wheat

#FoodandWaterSecurity

In a significant shift in Egypt's wheat procurement strategy, Mostakbal Misr for Sustainable Development, formerly the development arm of the Egyptian Air Force, has replaced the General Authority for Supply Commodities (GASC) as the country's sole importer of strategic commodities. The organization has already secured sufficient wheat supplies to meet national needs through June 2025.

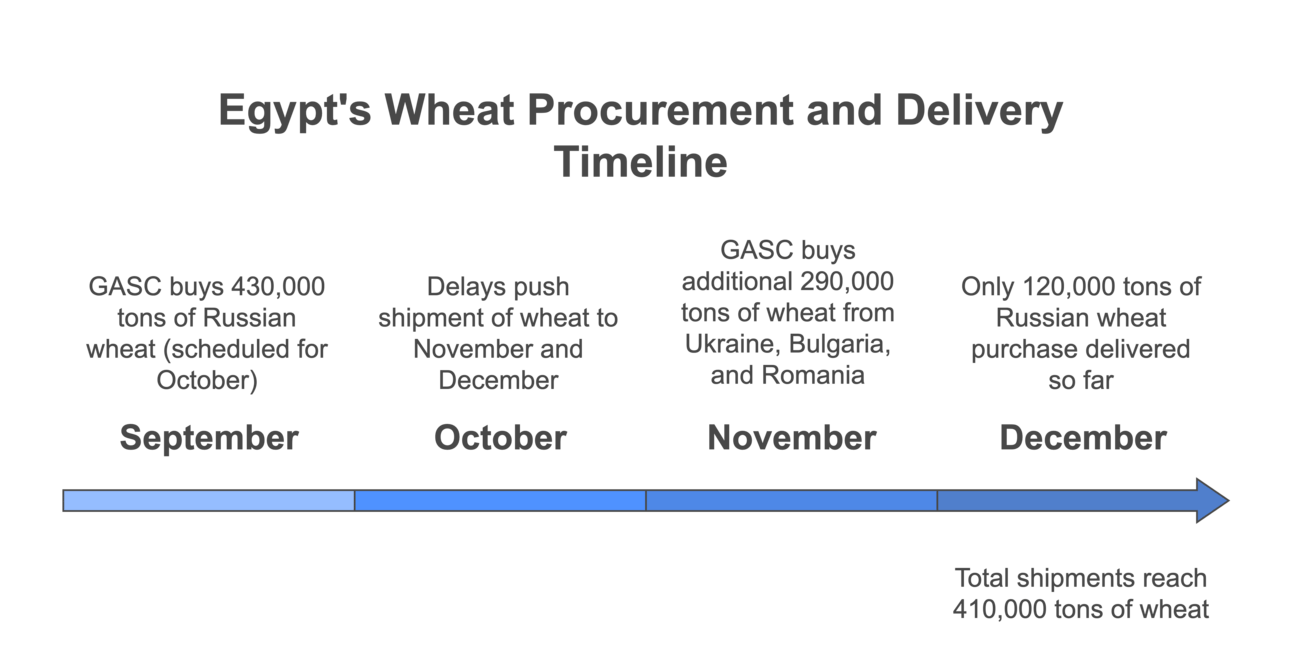

The change comes at a critical time as Egypt grapples with regional tensions affecting its wheat supply chain since August 2024. Recent wheat deliveries have faced challenges, with only 120,000 tons of a 430,000-ton Russian wheat purchase being delivered as scheduled (see Figure 2). Despite these challenges, the GASC has maintained its imports, securing an additional 290,000 tons in November.

Bread is a crucial staple in Egyptian society, with citizens consuming nearly double the global average of bread per person (150-180 kg compared to the global 70-80 kg). The government's commitment to maintaining wheat supplies is rooted in social stability, evidenced by historical protests in 1977, 2008, and 2011 related to bread availability.

SOMA’s Perspective:

This reorganization demonstrates Egypt's proactive approach to mitigating risks in an increasingly volatile region. The timing is significant given the regional tensions, the ongoing Grand Ethiopian Renaissance Dam (GERD) crisis affecting water security, and increasing refugee pressures. By centralizing strategic commodity imports, Egypt is creating a buffer against potential social unrest, learning from historical instances where bread availability triggered significant protests.

Sources:

https://www.reuters.com/markets/commodities/egypts-mostakbal-misr-secures-1267-mln-tons-mostly-russian-wheat-sources-say-2024-12-27/#:~:text=Mostakbal Misr%2C established in 2022,5 million tons per year.

https://books.google.ae/books?hl=en&lr=&id=P65_EAAAQBAJ&oi=fnd&pg=PT4&dq=wheat+importation+in+egypt&ots=oKb47qbN7q&sig=Gcb7LRJjgD2zAqI59fgVOeg0T-c&redir_esc=y#v=onepage&q=wheat importation in egypt&f=false

SOMA MATER is writing Intelligence Reports on the topics of Food and Water Security and Net Zero Transition. If you’d like to know more, contact us through the link below: